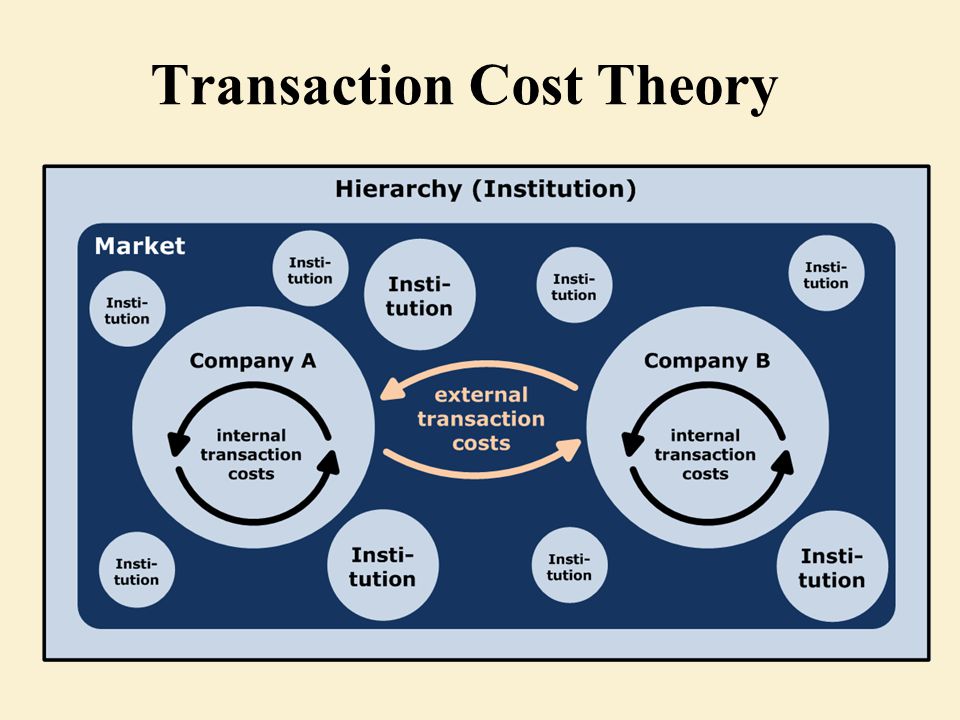

to try to explain when a firm should expand and when it should not, or even when the firm would do better to either break apart or sell off some of its business units. When many kinds of businesses are part of the same corporation, it may be difficult to synchronize different business cultures.Įconomists have developed a theory called transaction cost economics A theory that explains when a firm should expand, not expand, break apart, or sell off business units based on the costs involved in making exchanges.

#TRANSACTION COSTS SOFTWARE#

The culture of a successful manufacturer of consumer goods is not necessarily the culture of a startup software company. In effect, at some point the firm can experience diseconomies of scale and diseconomies of scope as the result of management complexity increasing faster than the rate of growth in the overall enterprise.Īnother problem with expansion, especially in the cases of vertical integration and conglomerates, is that different kinds of businesses may do better with different styles of management. Information overload results in the failure of key information to arrive to the right person at the right time. Still, as the number of layers increases, the complexity of communication grows faster than the size of the management staff. Large firms usually have some form of layered or pyramid management both to allow specialization of management and to facilitate communication. This requires additional management to manage the managers. Each manager only understands a small piece of the corporation’s operations, so there needs to be efficient communication between managers to be able to take advantage of the opportunities of integration and conglomeration. There needs to be some specialization among managers, much as there is specialization in its labor force. One consequence of a corporation growing large and complex is that it needs a management structure that is large and complex. However, as many of these large corporations learned, it is possible to become too large, too complex, or too diversified. In fact, during the last century successful businesses often engaged in horizontal and vertical integration and even became conglomerates due to such reasoning. At first glance, it may seem that expanding a business is often a good idea and has little downside risk if the larger enterprise is managed properly. We have discussed several reasons a firm may decide to expand. The Business History Seminar has been made possible by financial support from the Erasmus Research Institute of Management (ERIM) and the Vereniging Trustfonds Erasmus Universiteit Rotterdam.5.7 Transaction Costs and Boundaries of the Firm This episode teaches us about the costs of Soviet secrecy and raises basic questions about its purposes. For some months in 19, the Gulag's camp chiefs and central administrators struggled with this dilemma without achieving a resolution. As this secret was guarded more and more closely, the camps began to drop out of the Soviet economic universe, losing the ability to share necessary information and do business with civilian persons and institutions without disclosing a state secret: their own location. One of the Gulag's most important secrets was the location of its labour camps, scattered across the length and depth of the Soviet Union. The official rationale of secrecy was defense against external enemies.

The Soviet state had entered its most secretive phase.

In 1949 the Cold War was picking up momentum.

0 kommentar(er)

0 kommentar(er)